The most common reasons for losing Bitcoin can be broadly categorized as follows:

-

Lost or Forgotten Private Keys: One of the most common ways people lose access to their Bitcoin is by losing their private keys. The private key is essentially the password to access and transact with Bitcoin stored in a wallet. If it’s lost or forgotten, there’s typically no way to recover the Bitcoin.

-

Hardware Failure or Loss: Loss of the physical device (like a hard drive or a hardware wallet) where the Bitcoin wallet is stored can result in losing Bitcoin. This includes damage due to accidents, hardware malfunctions, or simply misplacing the device.

-

Phishing and Scam Attacks: Falling victim to phishing attacks or scams where individuals are tricked into revealing their private keys or sending their Bitcoin to fraudsters.

-

Sending to Wrong Address: Accidentally sending Bitcoin to the wrong address is another common error. Bitcoin transactions are irreversible, so if you send Bitcoin to an incorrect or non-existent address, it’s usually lost forever.

-

Exchange Failures or Hacks: Storing Bitcoin on exchanges can be risky, as exchanges can get hacked, go bankrupt, or have other issues leading to the loss of the Bitcoin stored with them.

-

Death Without Passing on Access Information: In cases where the owner of Bitcoin passes away without leaving access information (like private keys or wallet details), the Bitcoin can become inaccessible.

Another way that you could lose your cryptocurrency’s through is if the crypto exchange site that it is being held on goes bankrupt. When a crypto exchange goes bankrupt, the users of the exchange face the risk of losing their assets, face legal complexities, and may endure a long process of attempting to recover their funds, with no guarantee of full recovery. It highlights the importance of careful consideration of where and how to store cryptocurrencies.

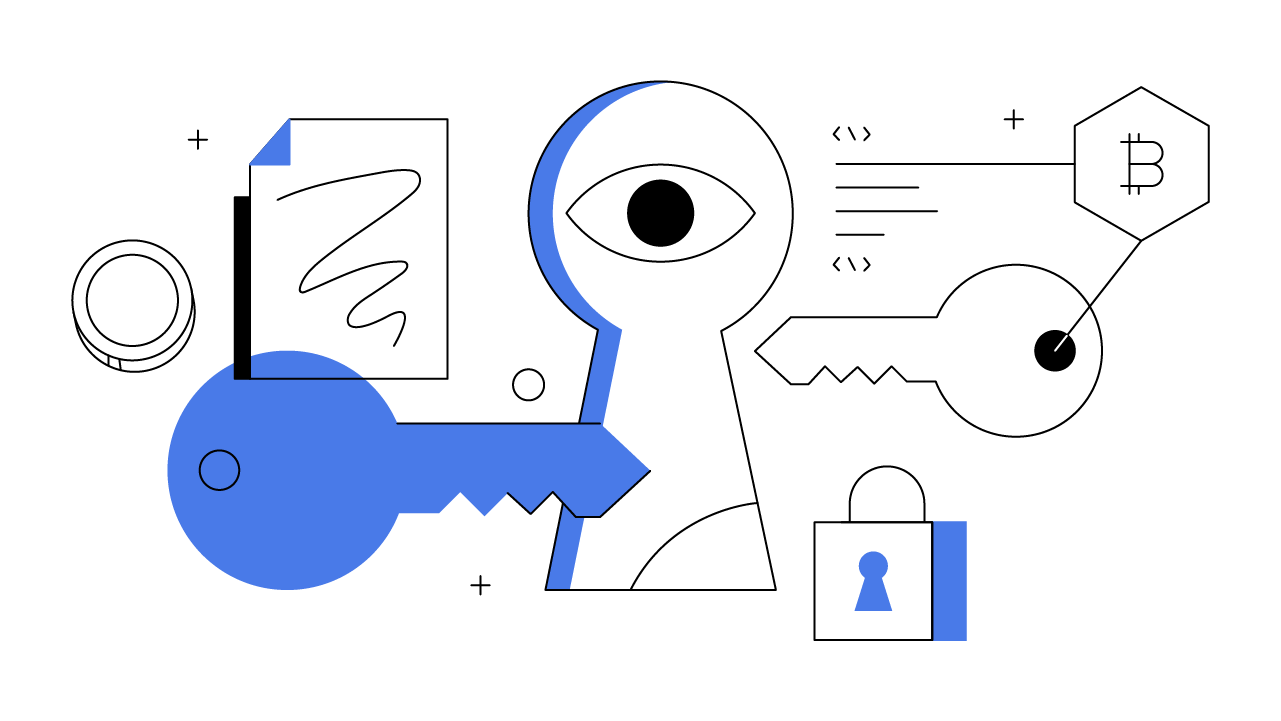

“Not Your Keys, Not Your Bitcoin”

The phrase “not your keys, not your Bitcoin” is a fundamental principle in the cryptocurrency community. It emphasizes the importance of personal control over one’s digital assets.

-

Ownership and Control: The ‘keys’ refer to the private keys associated with a cryptocurrency wallet. Having access to the private keys means having full control and ownership of the assets in that wallet. In contrast, if you don’t control the private keys (like when your assets are on an exchange or in a custodial wallet), you don’t have full control over your assets.

-

Risk of Third-Party Platforms: Storing Bitcoin on exchanges or with third-party services poses risks, as seen in cases of hacks, fraud, and bankruptcies. When your Bitcoin is on an exchange, the exchange controls the private keys, not you.

-

Importance of Self-Custody: The principle advocates for self-custody, meaning individuals should store their Bitcoin in wallets where they control the private keys. This approach minimizes reliance on third parties and reduces the risk of losing Bitcoin due to issues like exchange failures.

-

Security Responsibility: With control comes responsibility. Managing private keys requires understanding how to securely store and backup these keys, as losing them means losing access to your Bitcoin.

-

Educational Implication: It also implies the need for education and understanding of how Bitcoin and cryptocurrency wallets work. Users need to be knowledgeable about security best practices to protect their assets effectively.