No, Bitcoin is not a Ponzi Scheme.

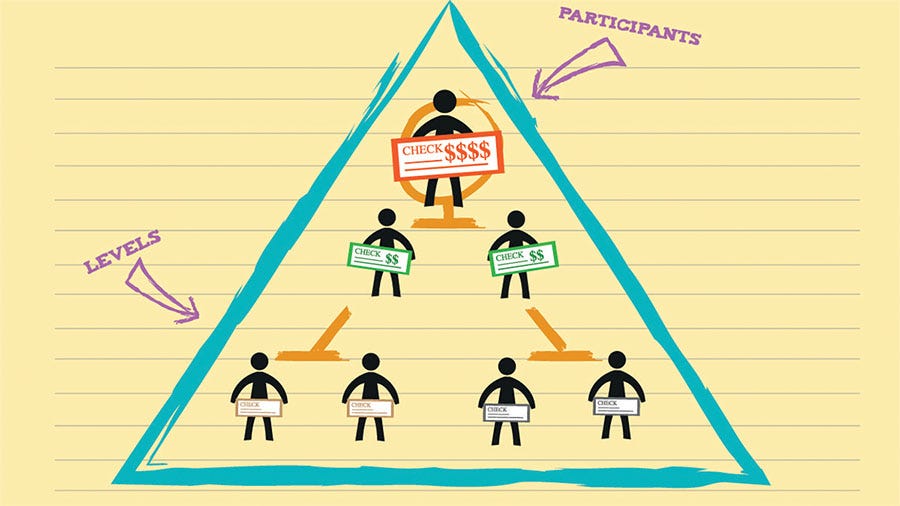

A Ponzi scheme is a fraudulent investing scam promising high rates of return with little risk to investors. It generates returns for older investors by acquiring new investors. This is similar to a pyramid scheme in that both are based on using new investors’ funds to pay the earlier backers. Ponzi schemes eventually collapse because they require a continual influx of new money to provide returns to earlier investors.

Bitcoin is a decentralized digital currency that operates on a technology called blockchain. It is not an investment scheme and does not promise returns. It’s a peer-to-peer system where transactions are verified by network nodes through cryptography and recorded in a public distributed ledger.

Unlike a Ponzi scheme, which is typically controlled by a central entity or individual, Bitcoin is decentralized. This means no single person, organization, or government controls it. Its value is determined by market demand and supply, not by a promise of returns by a central organizer.

Bitcoin’s transactions are recorded on a blockchain, which is a transparent and publicly accessible ledger. This level of transparency is contrary to the secretive and misleading nature of Ponzi schemes.

Bitcoin, like any other asset, carries investment risk. Its price can be highly volatile, and investors can gain or lose money. However, this risk is a result of market forces, not the fraudulent and deceptive practices characteristic of Ponzi schemes.

Bitcoin does not guarantee any returns to its holders. Its value can fluctuate widely based on various factors, including market sentiment, investor behavior, regulatory news, and technological developments.